Industry Pulse Survey

AMBA has launched periodic Pulse Surveys to give business leaders insight into the state of the mold building industry during the COVID-19 pandemic and what the industry may look like as businesses look further into 2020.

The short, one-minute survey takes the pulse of business operations by asking eight questions over a two-day period. As AMBA continues to collect data, AMBA will also begin to trend past results and forecast industry shifts based on the inputs from leaders in the mold building industry.

AMBA will continue to release periodic versions of this survey. To participate in the future, participants complete the questions via a personalized email link. If you did not participate in this first survey and would like to in the future, please request to be added to the respondent list by clicking here.

Pulse Survey Data

-

Week 1: Apr. 24 - Apr. 26

-

Week 2: May 6 - May 8

-

Week 3: May 20 - May 22

-

Week 4: Jun. 3 - Jun. 5

-

Week 5: June 23 - June 25

-

Week 6: July 15-17

-

Week 7: August 4-6

-

Week 8: August 26-28

This data represents over 800 responses from mold builders over the course of eight separate data collection periods (defined above). These companies primarily serve over 15 industry markets. The most common market served reported by respondents was the automotive market, followed by the medical market. Consumer goods is the third most commonly served market.

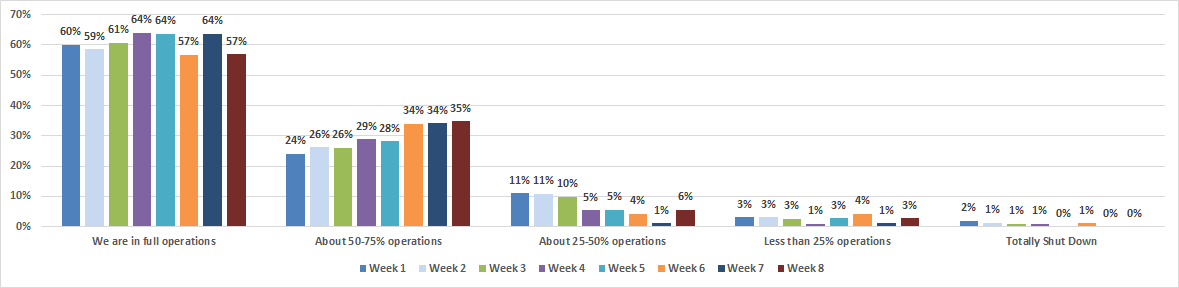

At what level is your plant currently operating?

In Week 8, those reporting full operations dropped to Week 6 levels, while those reporting 50-75 percent operations stayed the same. For the third week since this data collection has begun, zero companies report being totally shut down.

Of those that named automotive as their primary market:

- Despite a high of sixty-five percent of respondents who reported in Week 5 that they were in full operations, this week that percentage now hovers around 48 percent

- In Week 6, six percent of these respondents reported that they are at less than 25 percent of operations; this week, that percentage continues to be 0, although eight percent do report operation levels between 25 and 50 percent.

Of those that named medical as their primary market:

- This week, around 83 percent of those who primarily serve the medical market report now report full operations

- Although over 20 percent reported in Week 6 that they were running at 50 percent or less of operations, that percentage remains at zero during the Week 7 and Week 8 collection periods.

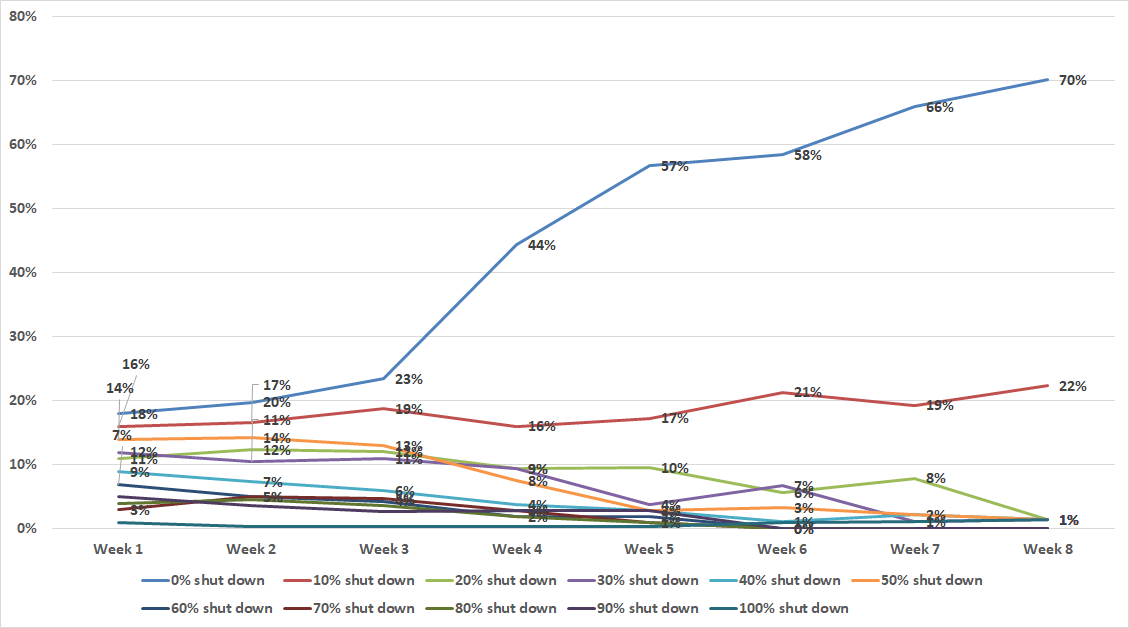

What percent of your customers are shut down?

This week, 70 percent of companies report that zero percent of their customers are closed down. This was by far the most popular response, followed by another 22 percent who indicate that ten percent of their customers are shut down.

All other shutdown percentages remained very low (under three percent) or at zero.

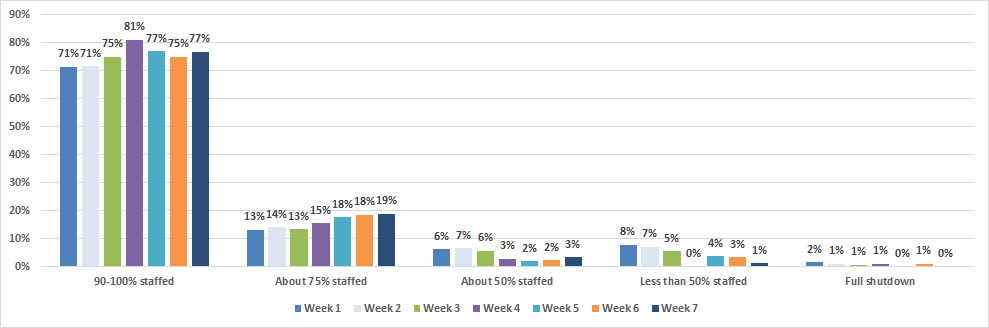

At what level are you currently staffed?

Staffing considerations for mold builders remained relatively stable again during this data collection period.

Over three-quarters of this survey's respondents report that they are 90-100 percent staffed, followed by 17 percent who are about 75 percent staffed. When looking at the other end of the data, the data is very similar - for the second time since the collection of this data, zero percent report that they are in a full shut down, while only one percent report that they are less than 50 percent staffed.

Of those that named automotive as their primary market:

- Seventy-six percent report that they are 90-100 percent staffed; while 24percent are about 75 percent staffed. None report less than 75 percent staffed (for the first time since the beginning of this data collection).

Of those that named medical as their primary market:

- Ninety-four percent of companies that specialize in the medical market report that they are 90-100 percent staffed, a slight rise over previous weeks

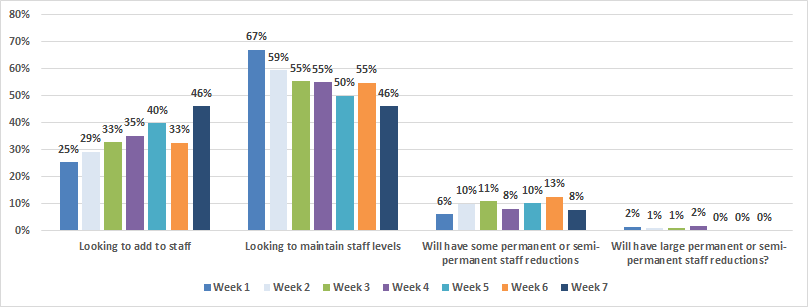

In terms of future staff planning (next 6-12 months), we are...(last reported in Week 7)

The percentage of companies interested in adding staff rose significantly compared to the last data collection period by 13 percent, while 46 percent look to maintain staff levels. The percentage of respondents reporting in this period that they will have some permanent or semi-permanent staff reductions dropped back to Week 4 levels of eight percent.

While those serving the automotive market primarily are focused on maintaining staff levels (65 percent of respondents), those who primarily serve the medical and consumer goods markets are significantly more focused on adding staff (62 percent and 86 percent, respectively).

When broken down by industry, these numbers have wavered - some weeks they have risen, others they have fallen - likely indicating that there continues to be a high level of uncertainty concerning current and future work in 2020 despite the re-opening of facilities.

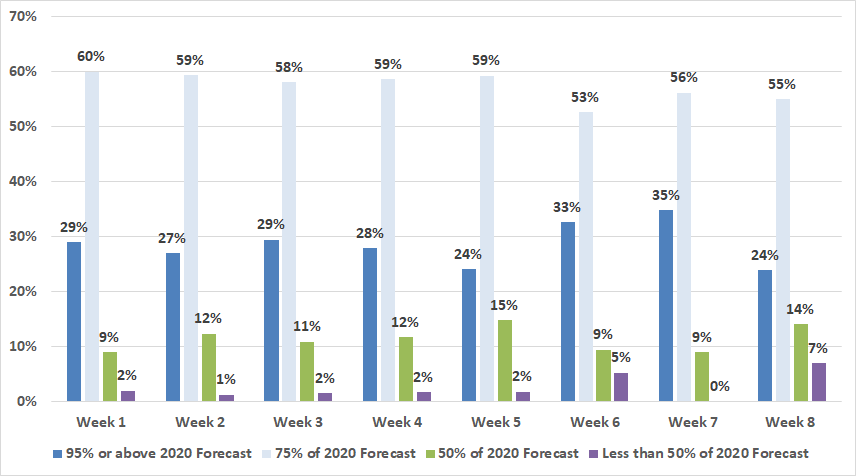

How are you forecasting revenue through 2020?

During this data collection period, respondents who report that they expect 95 percent or above of their 2020 forecast dropped to its lowest percentage of any collection period, returning for the first time to Week 4 levels.

When broken down by the primary markets served named by respondents - automotive, medical and consumer goods - reported anticipated forecast percentages included:

- Automotive: Twenty-four percent now anticipate 95 percent or above, followed by 60 percent who anticipate 75 percent of their 2020 forecast. Approximately 16 percent report anticipating 50 percent of their 2020 forecast.

- Consumer goods: This collection period, 14 percent of this demographic anticipate 95 percent or above of their 2020 forecast (a significant drop over the last collection period), followed by 71 percent who anticipate 75 percent; 14 percent anticipate less than 50 percent of their total revenue.

- Medical: Despite a maintenance of staffing levels, only thirty-five percent of respondents indicate anticipating 95 percent or above of the 2020 forecast, while 53 percent still anticipate only 75 percent of their 2020 forecast. Six percent now anticipate only 50 percent of their 2020 forecast, while another six percent anticipate less than that.

At this time, with the information available to you and your team, when are you anticipating production levels to return to "normal"? (Asked in all collection periods except Week 1)

During the Week 7 collection period, the AMBA team saw a huge surge in respondents' belief that product levels would not return to normal in 2020. For this reason, additional options regarding 2021 time periods were added. Notably, during this collection period, nearly half of all respondents indicated their belief that production levels would not return to normal until mid-to-late next year. The percentage of respondents who indicated that their production levels had not yet been impacted also dropped to a new low of 18 percent.

For the purposes of simplifying the appearance of the data, percentages are displayed only for Week 2, Week 7 or Week 8. The only exception is for Week 6, which shows the 47 percentage spike.

Additional Insights

Throughout these collection periods, miscellaneous questions have been added or removed depending on their timeliness and the environment and do not convey the same "trending" data as those above. For further insights into these particular topics, please see below.

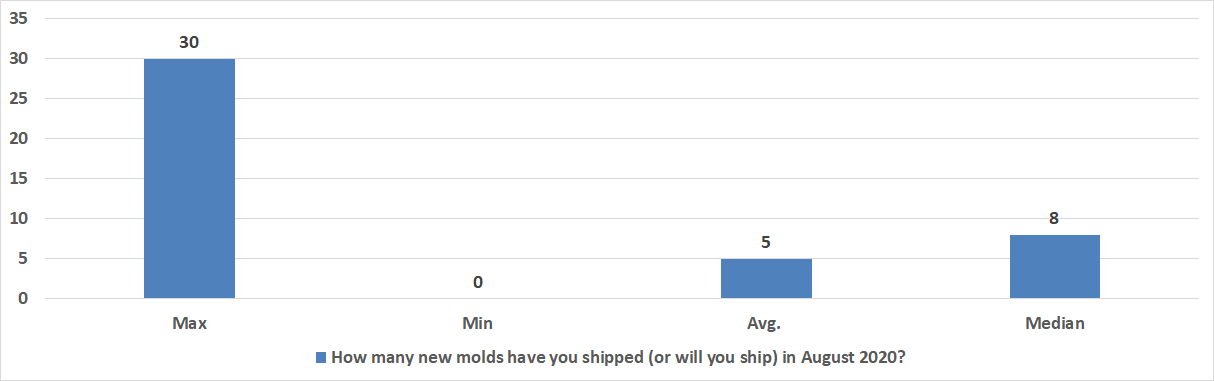

New Molds Shipped: August 2020

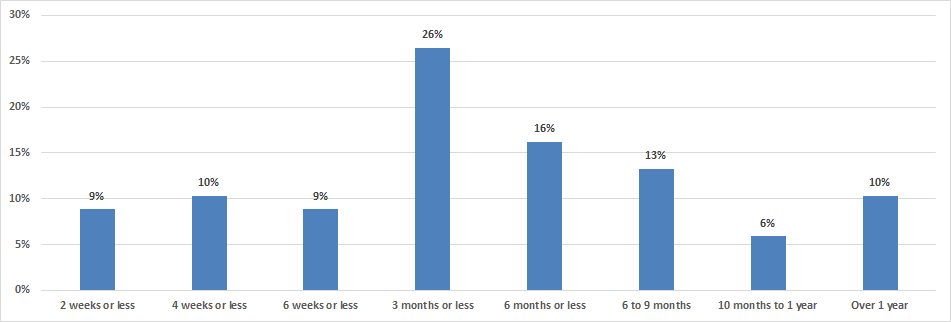

How many weeks of operating cash do you currently have on hand? (asked in Weeks 5 and 8 - only Week 8 is shown here)

When asked how much operating cash each respondent had on hand during the Week 8 collection period, answers varied widely. Where previously over one-third (36 percent) reported that they have less than six weeks of operating cash on hand, that number has just dropped to 28 percent. However, when further detail was requested, it was revealed that nine percent of respondents have less than two weeks of operating cash on hand, while ten percent have four weeks or less.

Just under one-quarter of respondents report having six months or more of operating cash on hand, which is very similar to previous data collection responses. When asking for additional detail, only ten percent indicate that they have over one year of operating cash on hand.

When broken down by primary industry served, over 60 percent of respondents serving the automotive market have between three and six months of operating cash, while over forty percent of those serving the medical market have between six or more months of operating cash on hand (one-third of which has over one year of operating cash on hand).

Lastly, those serving the consumer goods market are very evenly dispersed across all operating cash level; however, the largest percentage (nearly one-third) have approximately six weeks or less of operating cash on hand.

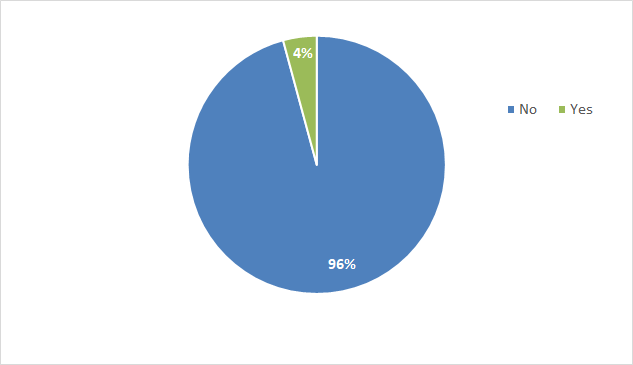

Have you reduced wages/salaries by more than 25% for any of your employees? (asked only in Week 6)

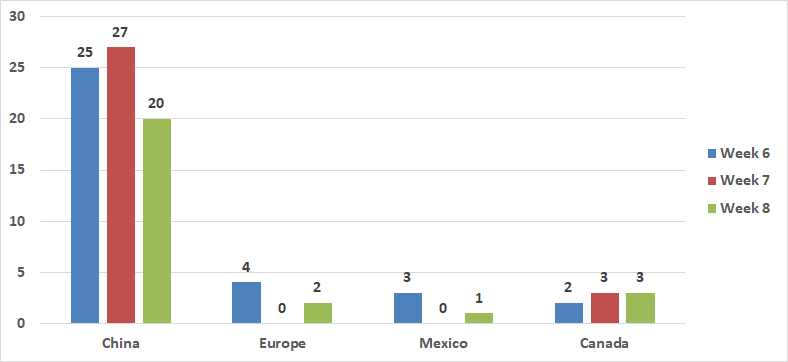

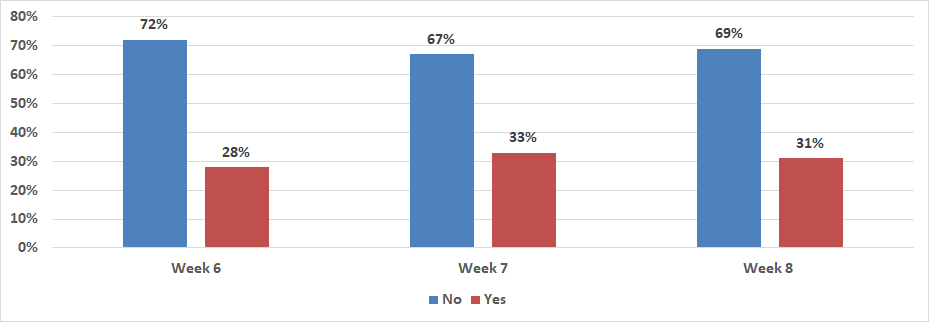

Since March 1, have you reshored/received new orders for products? (asked in Week 6, 7 and 8)

Of those companies who have had new products reshored, those reshored projects came from where? (asked in Week 6, 7 and 8)

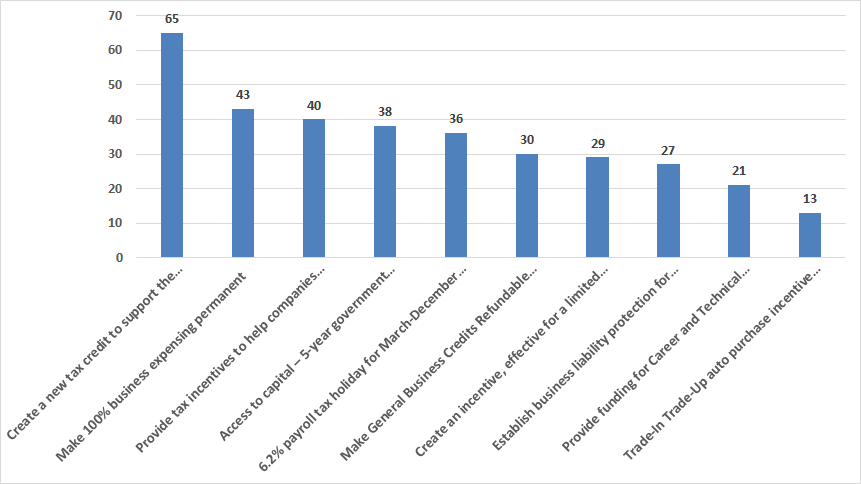

As Washington considers additional COVID-19 legislation to stabilize and stimulate the economy, please indicate the top priorities you would like to see Congress include.

Because the full responses are not listed above, they have been included below in order of most popular responses.

| Response Options | # of Respondents |

| Create a new tax credit to support the onshoring of manufacturing activities, such as moving operations to the U.S. or investing in capital equipment, to support the purchase of property, facilities and more | 65 |

| Make 100% business expensing permanent | 43 |

| Provide tax incentives to help companies recruit and train the skilled workforce needed to expand modern manufacturing in the U.S. | 40 |

| Access to capital – 5-year government guaranteed loans, 2% loans (not forgiven) for equipment, tools, materials, R&D and facility improvements/expansions | 38 |

| 6.2% payroll tax holiday for March-December 2020 | 36 |

| Make General Business Credits Refundable (General Business Credits include: R&D, investment, work opportunity, renewable, new markets, etc.) | 30 |

| Create an incentive, effective for a limited period of time after operations are moved to the United States, to help mitigate increased labor costs. | 29 |

| Establish business liability protection for employers | 27 |

| Provide funding for Career and Technical Education, MEPs, federal job training programs | 21 |

| Trade-In Trade-Up auto purchase incentive program | 13 |

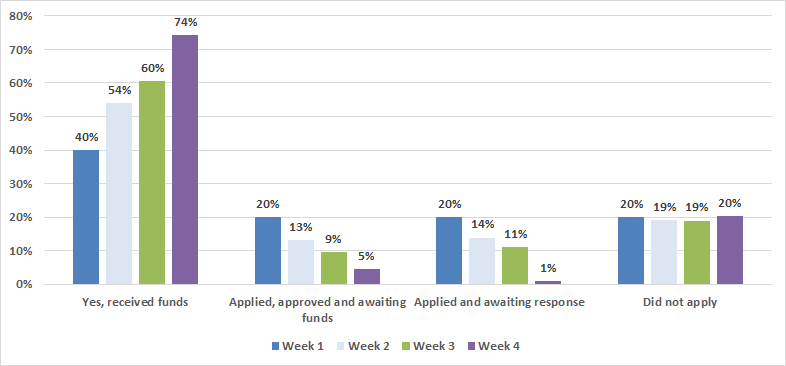

Have you received Payroll Protection Funds? (last week reported: Week 4)

Of the 112 respondents represented in Week 4, 74 percent have now applied for and received Payroll Protection Funds, followed by five percent who have applied, are approved and are waiting for funds to arrive.

When broken down by the primary markets served named by respondents - automotive, medical and consumer goods - the percentage of companies that applied for funds and were approved is as follows:

- Automotive: 81 percent received funds; 2 percent are approved and waiting for funds

- Consumer goods: 78 percent received funds; none are currently waiting for funds; 22 percent report not applying

- Medical: 75 percent received funds; none are currently waiting for funds; 25 percent report not applying

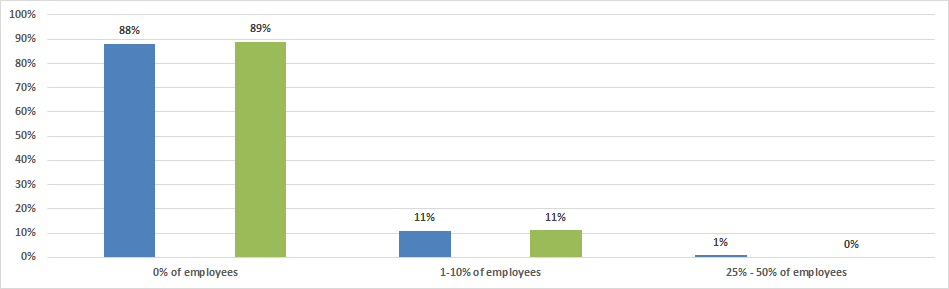

Very few mold builders report that their employees are out on referenced Acts asked in the above question; 88 percent indicate that zero percent of their employees are currently out, while 11 percent indicate that one-to-ten percent of their employees are out. Only one percent report significant employee loss due to this challenge.

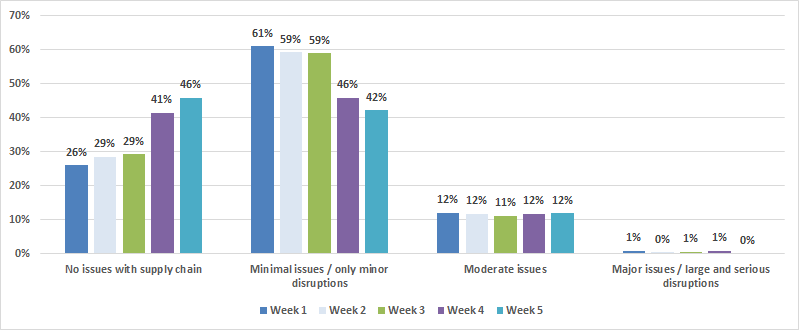

Are you experiencing supply chain issues that impact your ability to produce? (not asked in Week 6)

For the first time since the beginning of this survey, the percentage of respondents reporting no issues with the supply chain was higher than those reporting minimal issues and/or only minor disruptions in their supply chain (46 percent v. 42 percent). Zero percent report major issues and/or large and serious disruptions.